Nueces County Tax Protests Slice Taxable Value by Over $1 Billion

O'Connor discusses how Nueces County tax protests sliced taxable value by over $1 billion.

CORPUS CHRISTI , TX, UNITED STATES, October 22, 2025 /EINPresswire.com/ --Centered on Corpus Christi, Nueces County has a lot in common with Galveston County. While Texans usually picture them as simply being vacation destinations based on islands, both have excellent economies outside of tourism, burgeoning populations, and thriving housing markets. Nueces County does have limited space when it comes to prime real estate, causing competition for it to rage, increasing every year. As one of the most populated counties in Texas, Nueces sees a constant struggle between residents, businesses, and tourists for precious land.

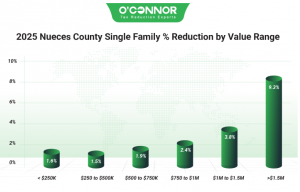

This increasing demand has led to skyrocketing property values, which in turn led to higher taxes. While exemptions are always helpful, property tax appeals are a nice addition that can be the difference between keeping a property or losing it and can certainly make things more affordable. In 2023, 18% of all properties in the county were protested, which was at the crest of a growing wave. In this article, we will compare initial property values before protests and see how they stack up against the results of informal and formal appeals. We will also look at how O’Connor clients were able to improve upon these results.

The Nueces County Appraisal District (Nueces CAD) assessed a 4% increase in residential properties in 2025, raising the total value of homes to $30.49 billion. When all informal and formal appeals were tallied up, this was reduced by 2.3% to $29.79 billion. Homes worth between $250,000 and $500,000 were the largest block of value at $11.24 billion, before they were lowered by 1.5% thanks to protests. Homes under $250,000 were cut by 1.6%, finishing at $9.37 billion. While the total value decreased, reductions grew as homes became more expensive. This culminated in a reduction of 9.3% for homes worth over $1.5 million, which resulted in a total of $1.20 billion. These mansions had previously seen a rise of 13.1%. O’Connor clients that protested their homes saw an overall cut of 12.3%, including a reduction of 10.5% for homes worth between $250,000 and $500,000.

Nueces County has historically been built around modest homes, and that can certainly be seen in the statistics. Homes under 2,000 square feet made up the biggest category of value, weighing in at $16.22 billion, though this was later lowered by 1.6% by appeals. Homes between 2,000 and 3,999 square feet saw their value be cut by 2.5% through protests but still contributed $12.04 billion. These two categories saw increases of 3.45 and 3.7% respectively. Homes between 4,000 and 5,999 square feet got a large reduction of 6.6%, resulting in a total of $1.40 billion. The largest homes experienced the biggest reduction, falling 12.7% to $115.08 million.

Homes in Nueces County tend to trend older, though new construction is starting to blossom as well. 32.3% or $9.62 billion in value came from homes built between 2001 and 2020, a common theme in Texas. These received a reduction of 2.3% after a jump of only 0.8%, representing great savings for taxpayers. 23.6% of the value came from homes built between 1981 and 2000, while 16.9% came from those constructed from 1961 to 1980. These saved 1.7% and 1.6% respectively. Homes older than 1960 contributed 17.5%, or $5.22 billion, to the total, though they received a reduction of 2.3%. New construction added 27.8% in value, rising to $2.95 billion before being cut down 5.1% to $2.80 billion.

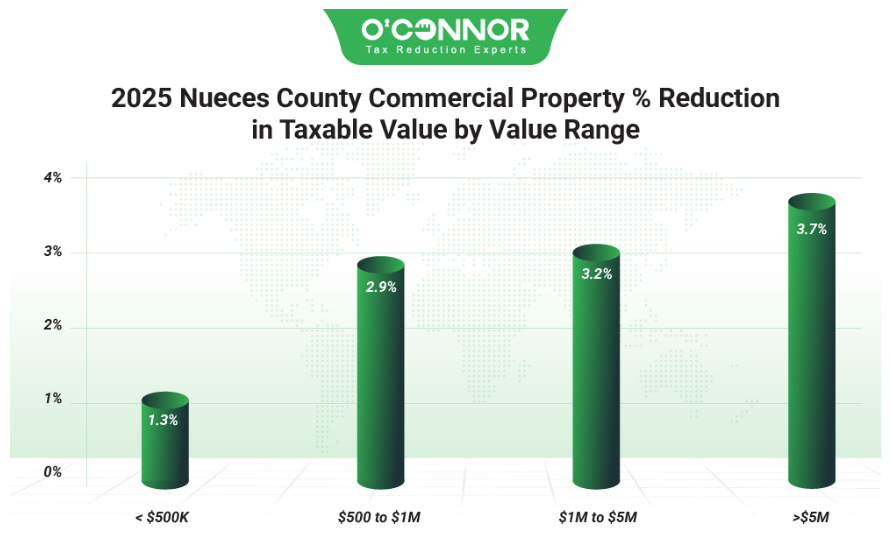

Appeals Reduce Commercial Taxable Value by $595 Million

While certainly not the hammering that many Texas counties received in 2025, Nueces still saw a solid jump of 4.6% in overall commercial property values. This took the total to $17.63 billion. While informal appeals struggled, when boosted by formal hearings, protests were able to trim 3.4%, leading to a final sum of $17.03 billion. The largest value, increases, and decreases were all generated by commercial properties worth over $5 million. Initially growing 4.5% to $11.98 billion, combined appeals managed to slash the total down by 3.4%, resulting in a new number of $11.53 billion. Those worth $1 million to $5 million came in a distant second with $2.92 billion after a cut of 3.2%. O’Connor was able to double the savings for our clients, including an overall reduction of 8.9% and a decrease of 9.5% for properties worth over $5 million.

Thanks to the demand for development and real estate as a whole, the largest category of commercial property was raw land, which was assessed at $10.31 billion before a small decrease of 0.2% thanks to appeals. Apartments were No. 2 with $3.26 billion, but this saw a huge cut of 10.6%, retreating to $2.91 billion. Apartments had previously risen 9.7%, so the gain was totally wiped out. Offices grew by 3.7%, but protests slowed this significantly with a decrease of 3.1%, resulting in a final sum of $1.57 billion. Retail dropped 4% to $1.07 billion, while warehouses shrunk 2.9%. These had previously seen increases of 11.9% and 2.7%. Hotels grew the fastest at 21.4% but were also reduced the most with 16.1%.

When looked at by date of construction, the largest timeframe, not counting raw land, was from 2001 to 2020. This produced $3.12 billion in value but was eventually protested down 7.8% to $2.88 billion. $1.87 billion came from properties constructed from 1981 to 2000, while $1.30 billion was created from 1961 to 1980. These saw reductions of 7.9% and 8.4% respectively. New construction added 21.4% in 2025, but this was again countered by combined informal and formal protests. This resulted in a decrease of 8.5% and a total of $336.01 million.

Protests Erase Office Increases

Offices in Nueces County originally added 3.7% to their total in 2025, reaching $1.62 billion. Property tax appeals were particularly effective in this scenario, and this resulted in a decrease of 3.1%. This drove the total under the 2024 number, with a final result of $1.56, which was quite the reversal. $696.411 million of the total came from offices built between 2001 and 2020, which was achieved thanks to a decrease of 3.5%. These offices had previously increased by 4%. After a cut of 2.6%, offices constructed between 1981 and 2000 accounted for $468.19 million. $213.66 billion came from offices built from 1961 to 1980, following a decrease of 2.8%. New construction finished with a value of $80.39 million, which was achieved after a slashing of 4.7%. O’Connor managed to score better results for our clients, landing an overall reduction of 3.3%.

Nueces CAD broke offices into several categories, a rarity for Texas appraisal districts. Offices in average condition were responsible for $695.24 million after a cut of 2.4%, while those in good condition reached $252.47 million after a solid drop of 4.5%. Those in excellent condition managed a decrease of 4.5%, reaching $135.73 million in taxable value. Medical offices were the second largest in terms of value and saw a total of $395.10 million after a reduction of 2.4%. Offices in low condition experienced a decrease of 5.9%, for a final sum of $88.15 million.

Boiler Point:

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.