Employers Can Help Extend WOTC

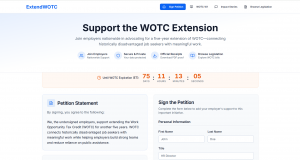

Employers can make their voices heard by visiting ExtendWOTC.com to: (1) sign the electronic petition and also (2) submit an Employer Impact Statement regarding their support of extending WOTC.”

DALLAS TEXAS , TX, UNITED STATES, October 21, 2025 /EINPresswire.com/ -- Since 1996, the Work Opportunity Tax Credit (WOTC) has played a vital role in connecting historically disadvantaged job seekers with meaningful employment opportunities. The program was created with a simple but powerful purpose: to help individuals who face significant barriers to employment such as veterans, long-term unemployed workers, SNAP recipients, and individuals with disabilities gain access to full-time work and self-sufficiency.— ExtendWOTC.com

For nearly three decades, employers have made this mission possible. By participating in WOTC, employers have not only strengthened their workforce, but helped transform lives, reduce dependency on government assistance, and drive economic growth within your communities.

However, the WOTC program is currently set to expire (or “sunset”) on December 31, 2025, unless Congress acts to extend or make it permanent.

Why Renewal Matters

Over the past several years, bipartisan lawmakers in both chambers of Congress have introduced multiple bills calling for renewal or permanent authorization, including:

The Improve and Enhance the Work Opportunity Tax Credit Act (2024–2025) - Introduced by Congressman Lloyd Smucker (R-PA) and co-sponsored by a bipartisan coalition, this bill seeks to modernize WOTC, expand eligibility for target groups, increase maximum credit values for long-term hires, and improve efficiency through technology.

The Work Opportunity Tax Credit Modernization and Improvement Act (2022–2023) - Sponsored by Senators Ben Cardin (D-MD), Roy Blunt (R-MO), and others, this legislation proposed extending WOTC through 2030 and modernizing certification through automation and data sharing.

The Renewing Opportunity in the Workforce Act (2024) - A bipartisan bill to extend WOTC for another five years and align target groups with current workforce needs.

Permanent Extension Proposals (2022–2025) - Multiple bipartisan members of Congress have supported making WOTC a permanent part of the Internal Revenue Code, similar to the R&D Tax Credit, to ensure long-term stability for employers and job seekers alike.

How Employers Can Help

While WOTC has historically enjoyed strong bipartisan support, renewal is not automatic and employers voices matters now more than ever.

Employers can act in two important ways:

Sign the Petition

Visit ExtendWOTC.com to sign the petition urging Congress to extend or make permanent the Work Opportunity Tax Credit program.

Submit an Employer Impact Statement

In addition to signing, employers are encouraged to share how WOTC has positively impacted their organization, their employees, and their community.

These Employer Impact Statements provide real-world context and powerful evidence to Congress, illustrating the tangible economic and social benefits of WOTC.

Employer-based stories, about improved retention, expanded hiring opportunities, and employee success, help lawmakers understand how critical this program truly is.

After signing and sharing their statement, employers are encouraged to contact their local Congressional Representative and U.S. Senators to emphasize that:

WOTC helps employers recruit, hire, and retain motivated employees.

WOTC reduces dependency on public assistance by helping individuals transition into the workforce.

WOTC works and deserves to be renewed or made permanent.

Philip Wentworth

Rockerbox

+1 469-461-1912

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.