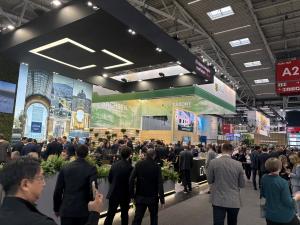

OAKHOUSE Reports Findings on 6% Yield Co-Living Properties Following Expo Real 2025 in Munich

OAKHOUSE shared insights from Expo Real 2025 in Munich, where its 6% yield co-living projects were presented, and outlined its U.S. market outlook for 2026.

TOSHIMA-KU, TOKYO, JAPAN, December 29, 2025 /EINPresswire.com/ -- How does OAKHOUSE maintain 6% yields? A comparison with Europe and the U.S. highlights characteristics of Japan’s co-living model

OAKHOUSE, a Tokyo-based co-living company, announced the results of a survey conducted at Expo Real 2025 in Germany, examining how European investors perceive income-generating real estate. The survey confirmed strong interest in the Japanese housing market. At the same time, the results indicated that co-living as an investment model is still relatively unfamiliar in Europe, suggesting that further explanation and information sharing may be valuable. OAKHOUSE’s continued track record of maintaining a 6% yield was also noted by participating investors.

According to the U.S. Multifamily Investor Report published by CBRE in July 2025 and data from Global Property Guide released the same month, average real estate yields (cap rates) in major U.S. cities are generally reported in the 4% to 5% range (e.g., 6.51% in New York and 4.64% in Los Angeles). In this context, OAKHOUSE’s reported 6% yield represents a point of comparison when examining differences among international residential investment markets.

How OAKHOUSE maintains yields and occupancy rates

These differences in yields are largely attributed to variations in management structure. Founded in 1992, OAKHOUSE has accumulated operational experience in managing co-living complexes over several decades. In Japan, securing rental housing can be challenging for foreign residents, and OAKHOUSE focuses on addressing this segment. As a result, the company reports an average annual occupancy rate of 98%.

OAKHOUSE concentrates its properties in the Tokyo metropolitan area, Kyoto, Osaka, and Kobe. Within these regions, the company manages approximately 5,000 furnished co-living units and apartments.

A defining feature of OAKHOUSE’s properties is their international resident community. Residents live in a multicultural environment where they are exposed to Japanese culture and other cultures on a daily basis. The company also organizes more than 300 events annually through a dedicated smartphone application. These initiatives are intended to support long-term residency and stable property operations.

Future Initiatives

OAKHOUSE plans to continue strengthening communication with overseas investors while sharing information about its operational approach and properties.

■ Contact

For inquiries from prospective tenants and investors considering purchasing a property, please contact us below.

- For property purchases and investments: katayama@oakhouse.jp

- “Zipang,” web site for foreign investors: https://www.zipang.oakhouse.jp/

About OAKHOUSE

OAKHOUSE is a housing service for foreign immigrants to Japan with over 30 years of experience. They offer furnished apartments with no deposit, no key money, no guarantor fees, and no contract renewal fees. Contracts start from as little as one month, rent can be paid with a credit card, and the entire process from first contact to signing the contract can be conducted in Chinese and English. They operate in areas where many foreign people need long-term accommodations, such as Tokyo, Kyoto, and Kobe. OAKHOUSE has an established reputation for its community management that places an emphasis on interaction among residents and plans and holds over 300 parties and events each year, allowing residents to experience the joy of co-living in a multinational environment on a daily basis. The company motto is "Enjoy living."

LAM THUY LINH

Oakhouse Co., Ltd.

8012714099398

l.lam@oakhouse.jp

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.